Address

304 North Cardinal St.

Dorchester Center, MA 02124

Work Hours

Monday to Friday: 7AM - 7PM

Weekend: 10AM - 5PM

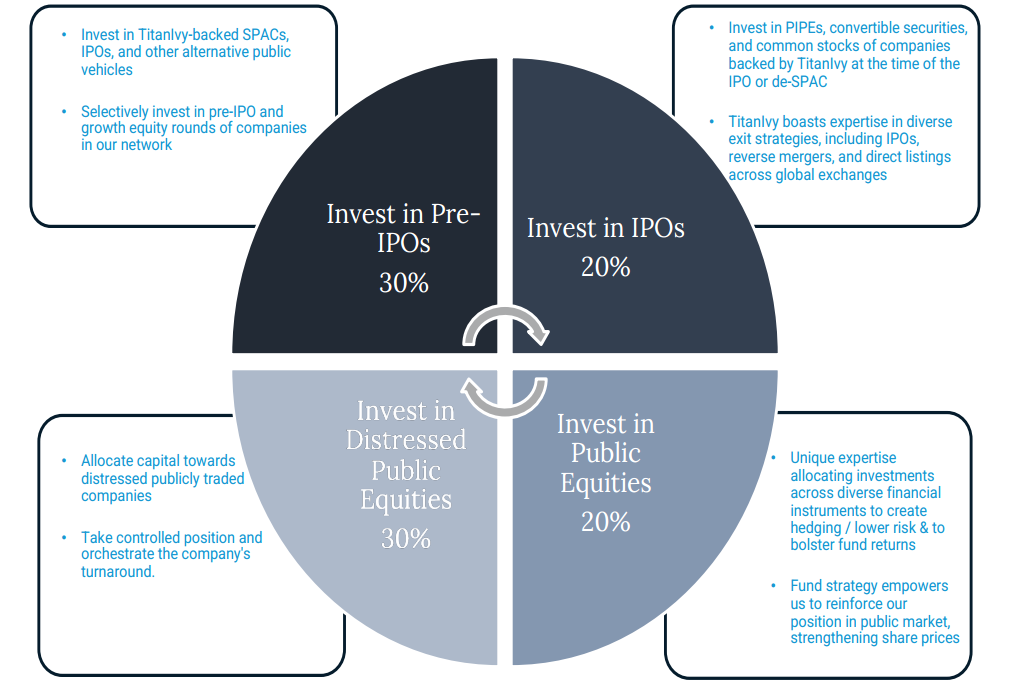

TitanIvy allocates capital towards distressed publicly traded companies. We take controlled position and orchestrate the company’s turnaround.

TitanIvy International is a global crossover / pre-IPO fund managed by a team that has collectively achieved exits worth over $20 Billion+.

Selectively invest in pre-IPO and IPO headed growth equity rounds of companies in our network

TitanIvy boasts expertise in diverse exit strategies, including IPOs, reverse mergers, and direct listings across global exchanges

Significant expertise Investing in TitanIvy-backed SPACs, IPOs, and other alternative public vehicles

Expertise taking controlled position and orchestrating company

turnarounds.

Allocate capital towards

operationally sound “toxic debt” & distressed publicly traded companies

Take positions in PIPEs, convertible securities, Last-in/First-out positions and common stocks of companies at the time of the IPO or de-SPAC

Team Strength

Extensive expertise in steering the operations of

publicly traded companies & current and past engagements have involved pivotal roles as Chairman, CEO, and Board Members in notable organizations, including The Bancorp, ApolloMed, Clinigence Holdings,

and Cardio Diagnostics.

Have been involved with 10 SPACs, raising a

total of $2 billion+ in capital, successful closure

and announcement of 7 de-SPAC transactions,

totaling a transaction value of $5 billion+

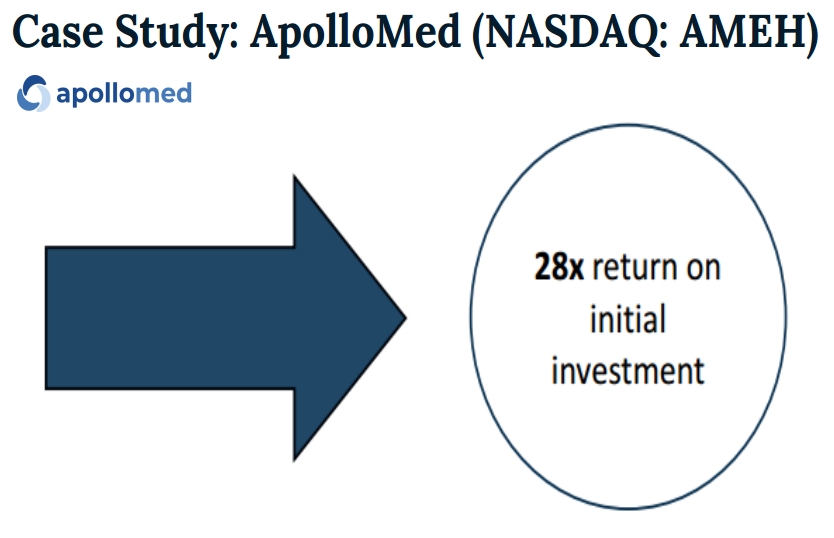

Co-founded ApolloMed (NASDAQ: AMEH),

completed IPO in 2008, raised over $200

million in capital. Peak market cap of $1.4

billion during Warren’s tenure. Private

placement investors generated 28x+ their

investments

Co-founded The Bancorp, led the company

through its IPO in 2000. Under Frank’s

leadership, from 1999 to 2006, the stock price

surged from $9.50 to $28.50, a return of 200%+

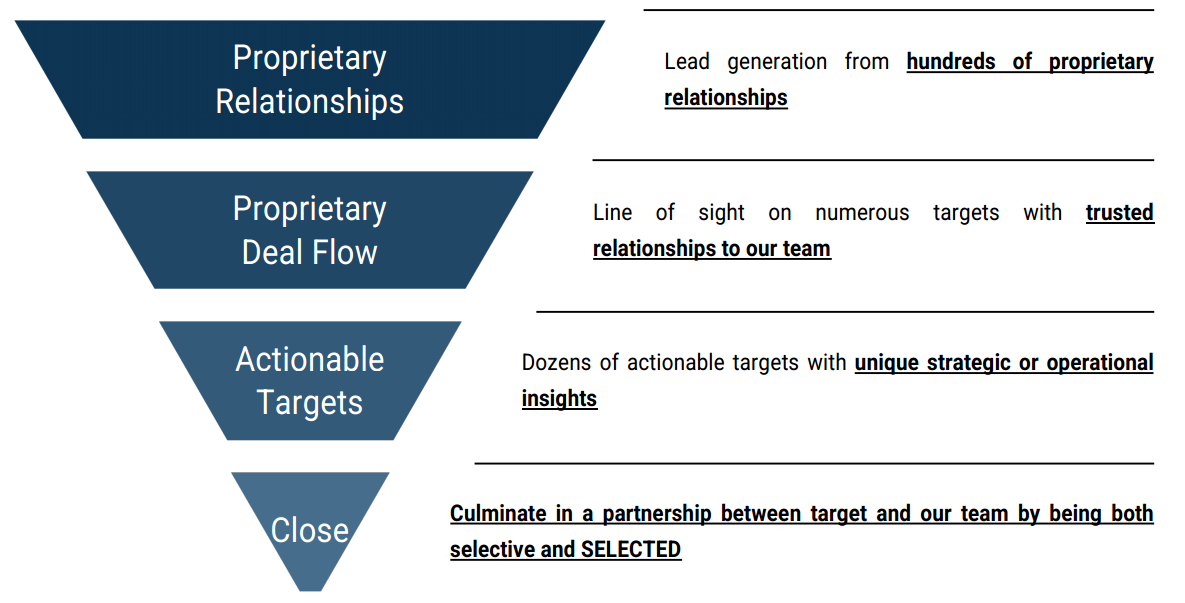

Our seasoned team boasts decades of experience successfully operating both public and private enterprises, We possess exclusive deal flow in a fiercely competitive environment.

Forward-looking vision with deep innovation experience

Uniquely positioned with a proprietary angle

Understand value creation and strategic opportunities

Deep resources, domain experience and expertise